- Sen. Catherine Cortez Masto (D-Nevada) right now launched the FULL HOUSE Act

- The invoice will repeal the playing deduction lower within the One Huge Stunning Invoice Act

- It’s the second launched invoice from a Nevada politician this week to repeal the playing deduction lower

Nevada politicians are cornering the market on payments to repeal the federal playing deduction lower included in President Donald Trump’s (R) One Huge Stunning Invoice Act.

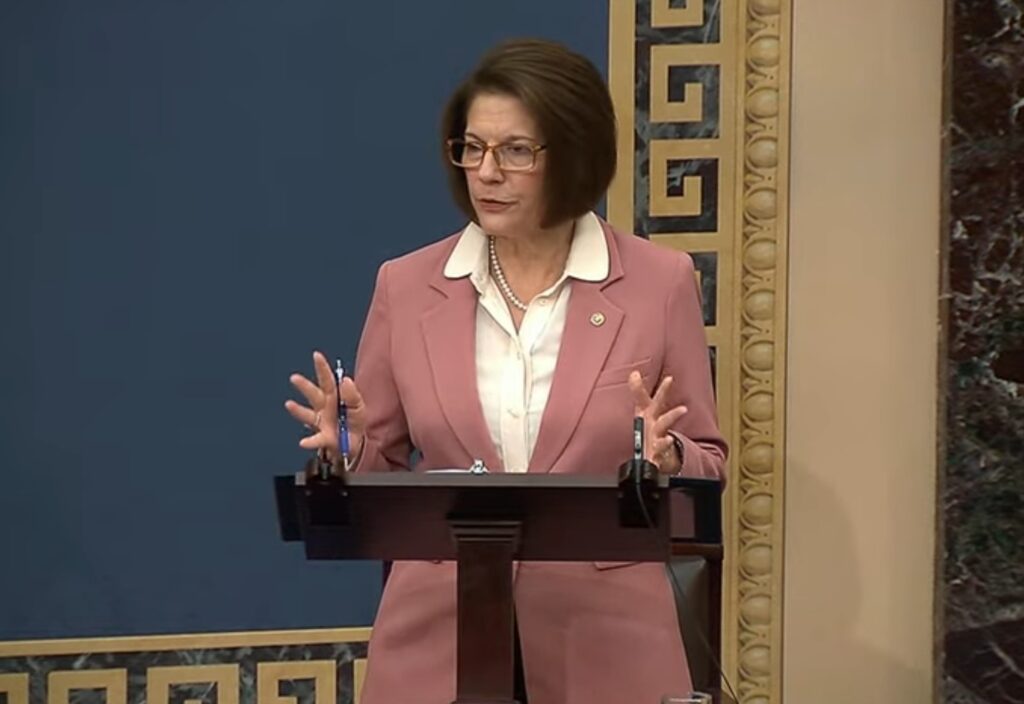

Sen. Catherine Cortez Masto (D-Nevada) right now launched the Facilitating Unbiased Loss Limitations to Assist Our Distinctive Service Financial system (FULL HOUSE) Act, which can restore an expert gambler’s potential to deduct 100% of playing losses – so long as it doesn’t eclipse their winnings – on their federal tax returns.

Cortez Masto launched the invoice right now on the Senate ground by way of unanimous consent, however the laws did obtain an objection. Cortez Masto will now need to undergo the formal voting process to go her invoice.

Second Invoice Launched This Week to Overturn Wagering Loss Deductions

Cortez Masto’s invoice, S2230, is one web page lengthy and amends the part of the One Huge Stunning Invoice Act that solely permits skilled gamblers to deduct 90% of their losses on their federal tax returns.

Trump’s invoice, Cortez Masto stated throughout a Senate listening to right now, will likely be detrimental not solely to Nevada, however to the U.S. gaming business as a complete. It should push prospects to unregulated black markets and unfairly punish the Nevada tourism business.

“This ridiculous gaming tax is one thing we will repair right now. This provision being included within the tax invoice is a results of Republicans haphazardly inventing new price range guidelines to ram their debt busting invoice by Congress. These new guidelines they made up pressured them to make adjustments to present coverage, even when it made that coverage worse for People, and that’s what occurred right here,” Masto stated throughout a Senate listening to right now.

Sen. Todd Younger (R-IN) formally objected to the request for unanimous consent of the FULL HOUSE Act. Younger requested Cortez Masto amend her invoice to additionally restore tax exemptions for sure spiritual establishments that had been stricken from the One Huge Stunning Invoice Act, which Cortez Masto declined to incorporate.

Cortez Masto will now the best way to undergo the formal approval course of to legalize her invoice.

“I’m disenchanted, however I’m not executed. I promise you this, we’ll proceed to work to the S2230 handed, it’s simply frequent sense. It has bipartisan help right here within the Senate,” Cortez Masto stated.

Criticism for One Huge Stunning Invoice Act

Trump’s sweeping laws was accredited on Thursday, July 3, with the president signing the invoice into regulation on July 4.

Included within the huge piece of laws was a brand new tweak to the Inner Income Code, which solely permits skilled gamblers to deduct 90% of their losses in a 12 months, down from 100%.

Nonetheless, this overhaul of the Inner Income Code obtained ire from skilled gamblers who stated it’s going to power customers to flock to the black markets for his or her gaming functions. It unfairly punishes those that precisely report their playing wins to the federal authorities annually, many stated.

Moreover, HuffPost reported that quite a few Republican Senators had no concept the supply had even been included within the invoice.

“For those who’re asking me the way it acquired in there, no, I don’t know,” Sen. Chuck Grassley (R-Iowa) stated throughout an interview with HuffPost earlier this week.

Cortez Masto alluded to this, as she famous throughout her invoice introduction that she’s “undecided any of my Republican colleagues even knew this was within the invoice they handed.”

Nevada Consultant Counterpart Additionally Launched Invoice

Cortez Masto’s Nevada counterpart in Congress, Rep. Dina Titus (D-Nevada) additionally launched an analogous invoice this week.

Titus, together with Rep. Ro Khanna (D-CA), launched the FAIR BET Act, which can restore the supply that permits skilled gamblers and sports activities bettors to deduct 100% of their losses from their taxes.

“It pushes folks into the black market in the event that they don’t do regulated gaming as a result of they’ve a tax drawback. The black market doesn’t pay taxes, it isn’t regulated, doesn’t assist with drawback gaming. It’s dangerous for the business and it’s dangerous for the participant,” Titus stated throughout an look on Information Nation.

Titus right now stated on her social media channel she is unsurprised the invoice didn’t obtain unanimous consent. One of the best probability for the repeal, she stated, is for each chambers to unite behind her FAIR BET Act.

The failure of the Senate’s unanimous consent measure isn’t a surprise. The Senate acquired us into this mess and it’s now time for each chambers to unite behind my bipartisan FAIR BET Act to make sure that common and high-stakes gamblers don’t pay taxes on cash they by no means gained.

If…

— Dina Titus (@repdinatitus) July 10, 2025